irvine income tax rate

2020 sales tax rates differ by state but sales tax bases also impact how much revenue is collected and how it affects the economy. Thus for example if a tax preparer committed an errorintentionally or unintentionallyon Forms 1040 1040A 1040EZ 1041s or 1065 partnership and 1041 grantor.

How To Fill Out Your W 4 Form In 2022 Tax Forms W4 Tax Form Form

Home page for the University of California Irvine.

. Irvine ˈ ɜːr v aɪ n is a master-planned city in South Orange County California United States in the Los Angeles metropolitan areaThe Irvine Company started developing the area in the 1960s and the city was formally incorporated on December 28 1971. A number of corporations. New Hampshire only.

However you do not make your tax payment until May 20 and the adjusted interest rate shown at the bottom of your tax return is 0075 9 12. Irvine Core Office Trust 2013-IRV. 211 How Economists Define and Compute Unemployment Rate.

The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. Now you would owe twice. She graduated magna cum laude with a BA from the University of California Irvine in 1998 and was inducted into the Phi Beta Kappa Honors Society the same year.

New Hampshire only taxes dividend income and capital gains. Your tax amount due is 1000 and payment is due on or before April 30. Luckily Apartment Finder provides 7 subsidized or section 8 rental homes in Irvine so you can find the best fit for you and your family.

Above these income thresholds new marginal tax rates were created by the passage of Prop 30. IRS 1040 Individual Income Tax forms for the 2018 tax year are arranged for a photograph in Tiskilwa Ill March 11 2019. The property tax rate in the county is 078.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. The states with no income tax are. If you know or suspect that you are the target of an IRS criminal tax investigation contact the dual licensed Criminal Tax Defense Attorneys CPAs at the Tax Law Offices of David W.

One shortcoming of an ESBT is that its S corporation portion is subject to the highest rate of income tax on ordinary income currently 396. Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming. 212 Patterns of Unemployment.

The city had a. Its base sales tax rate of 725 is higher than that of any other state and its top marginal income tax rate of 133 is the highest state income tax rate in the country. Doesnt seem like much each year but given enough time it has a huge impact.

62 How Changes in Income and Prices Affect Consumption Choices. Fort Worth had an owner-occupied housing rate of 564 and renter-occupied housing rate of 436. Corporate entities in the United States are currently subject to a federal corporate tax rate of 21.

Cinema 4d r19 plugins free download. Founded in 1965 UCI is the youngest member of the prestigious Association of American Universities and is ranked among the nations top 10 public universities by US. Daniel AckerBloomberg via Getty Images Getty Images.

Love nothing better than when deep and liquid markets operate under conditions of perfect information says Jessica Irvine National Economics Editor for. The Golden State fares slightly better where real estate is concerned though. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path.

Proposition 30 raised the statewide sales tax rate from 725 to 750 effective January 1 2013. News World ReportThe campus has produced five Nobel laureates and is known for its academic achievement premier research innovation and. Find the ideal rental including low income and no credit check apartments for less than by browsing our.

A seemingly small inflation rate of 3 will erode the value of your savings by 50 over approximately 24 years. Rental price 70 per night. California has among the highest taxes in the nation.

You want an affordable home that fits your needs. Many local municipalities impose additional sales taxes on top of the standard statewide rate. In the past a tax preparer was not liable for gift Form 709 and estate and generation-skipping Form 706 tax returns.

Check out the latest breaking news videos and viral videos covering showbiz sport fashion technology and more from the Daily Mail and Mail on Sunday. 2020 sales tax rates. Bakersfield CA Tax Attorney.

Where foreign information reporting and income tax reporting is purposefully not. The median income in 2018 was 58448 and the mean income was 81165. Where the rating agencies rate a security differently Lord Abbett uses the average rating based on numeric values assigned to each rating.

The Castle Douglas side ran out 9-0 winners with boss Vinnie Parker believing his players showed they are up for the fight. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. Shareholders may have to pay tax on the earnings.

When a CFC has Subpart F income under IRC Section 952 that means the US. To Assuming the same facts as above except you did not submit your tax return until June 3. Make proclamations set the city tax rate approve the city budget and appoint the city secretary city attorney city auditor municipal court judges.

The Lord Abbett Short Duration Income Fund seeks to deliver a high level of current income consistent with the preservation of capital. Irvine CA Income Restricted Apartments for Rent. But a tax preparer was liable for income tax returns.

The trustee must make the election to treat a trust as an ESBT within the two-month-and-16-day period beginning on. Irvine Tax Attorney. Los Angeles Tax Attorney.

We can provide you with a reduced rate assessment for your first call to our offices at 800 681-1295. The 66-square-mile 170 km 2 city had a population of 307670 as of the 2020 census. 3173 0515.

S Corporation Income Taxation. Per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s while per capita sales in border counties in Vermont have remained stagnant. Unreported inheritances investments real estates or business activity.

Essentially Subpart F Income involves CFCs Controlled Foreign Corporations that accumulate certain specific types of income primarily passive income. The first small jet-powered civil aircraft was the Morane-Saulnier MS760 Paris developed privately in the early 1950s from the MS755 Fleuret two-seat jet trainerFirst flown in 1954 the MS760 Paris differs from subsequent business jets in having only four seats arranged in two rows without a center aisle similar to a light aircraft under a large. By Sid Siddiqui Irvine Calif.

Why Households Need 300 000 To Live A Middle Class Lifestyle

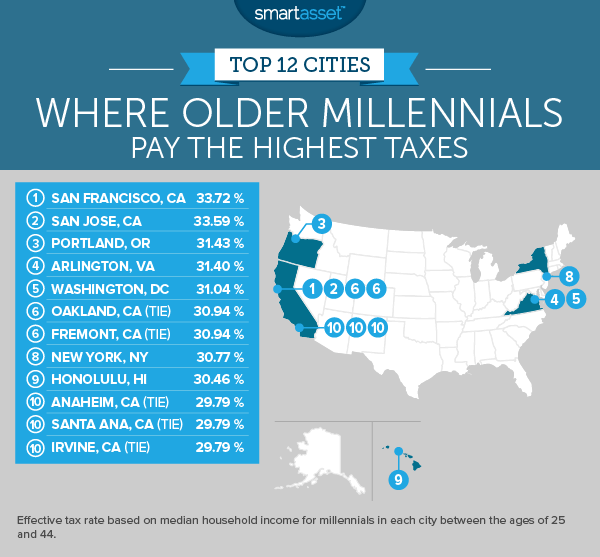

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Pin On Tax Relief And Legal Updates

California Corporations Pay Far Less Than Nominal Tax Rate Orange County Register

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

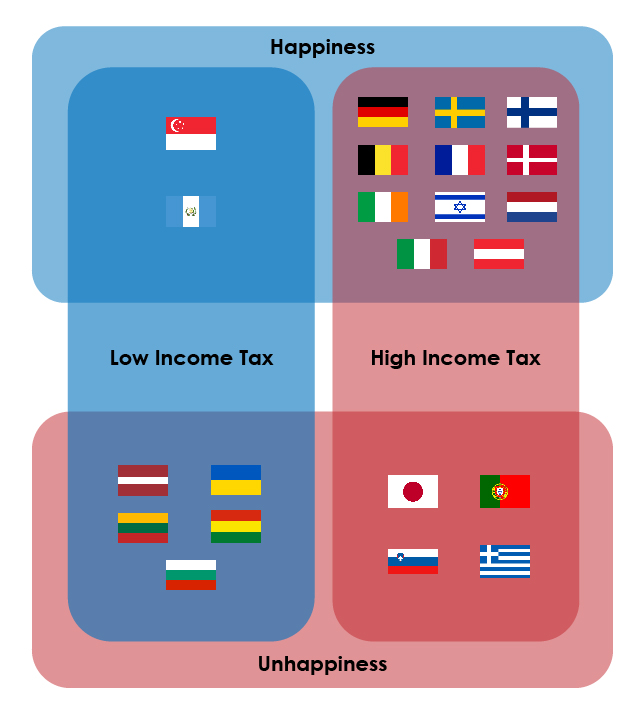

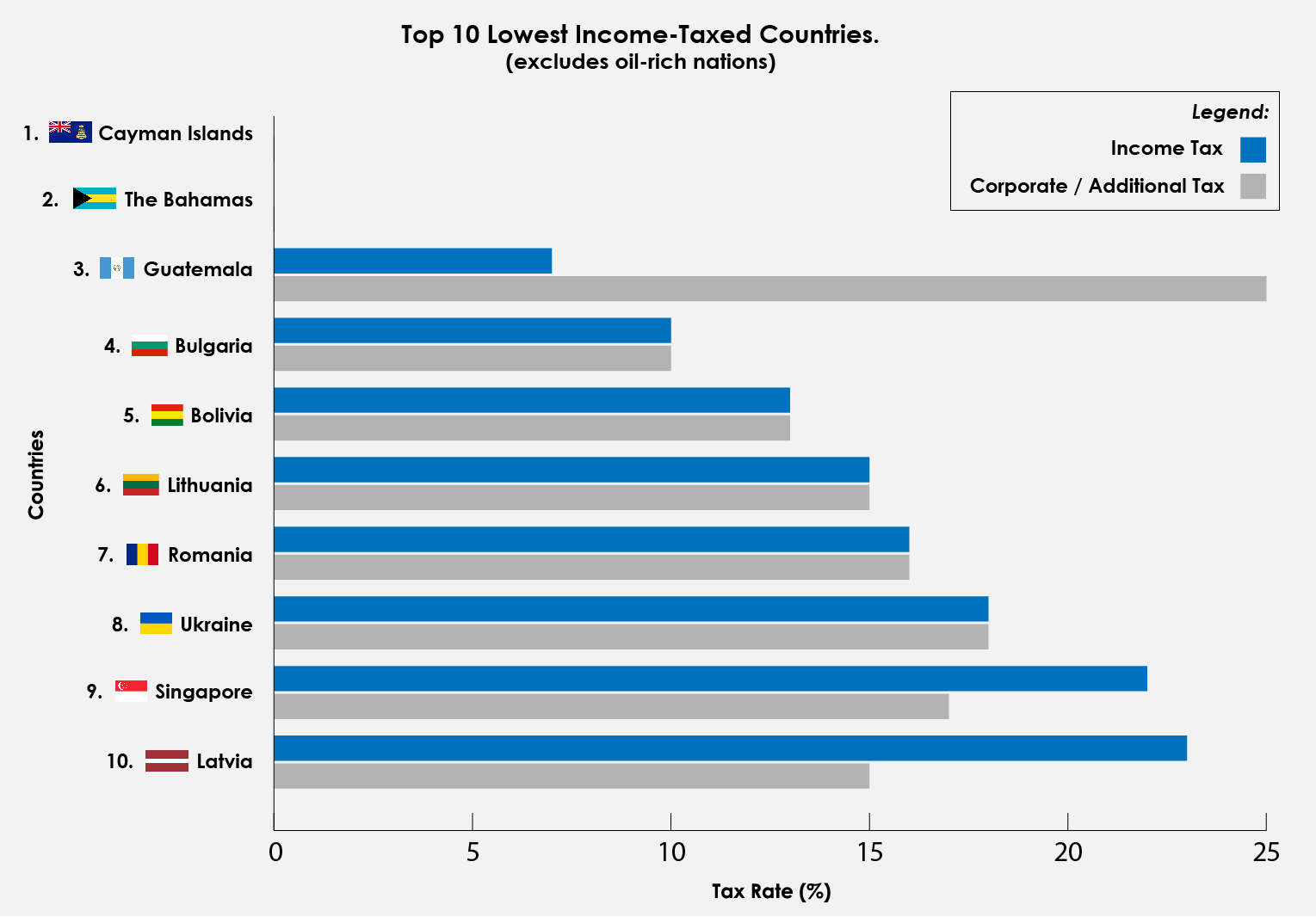

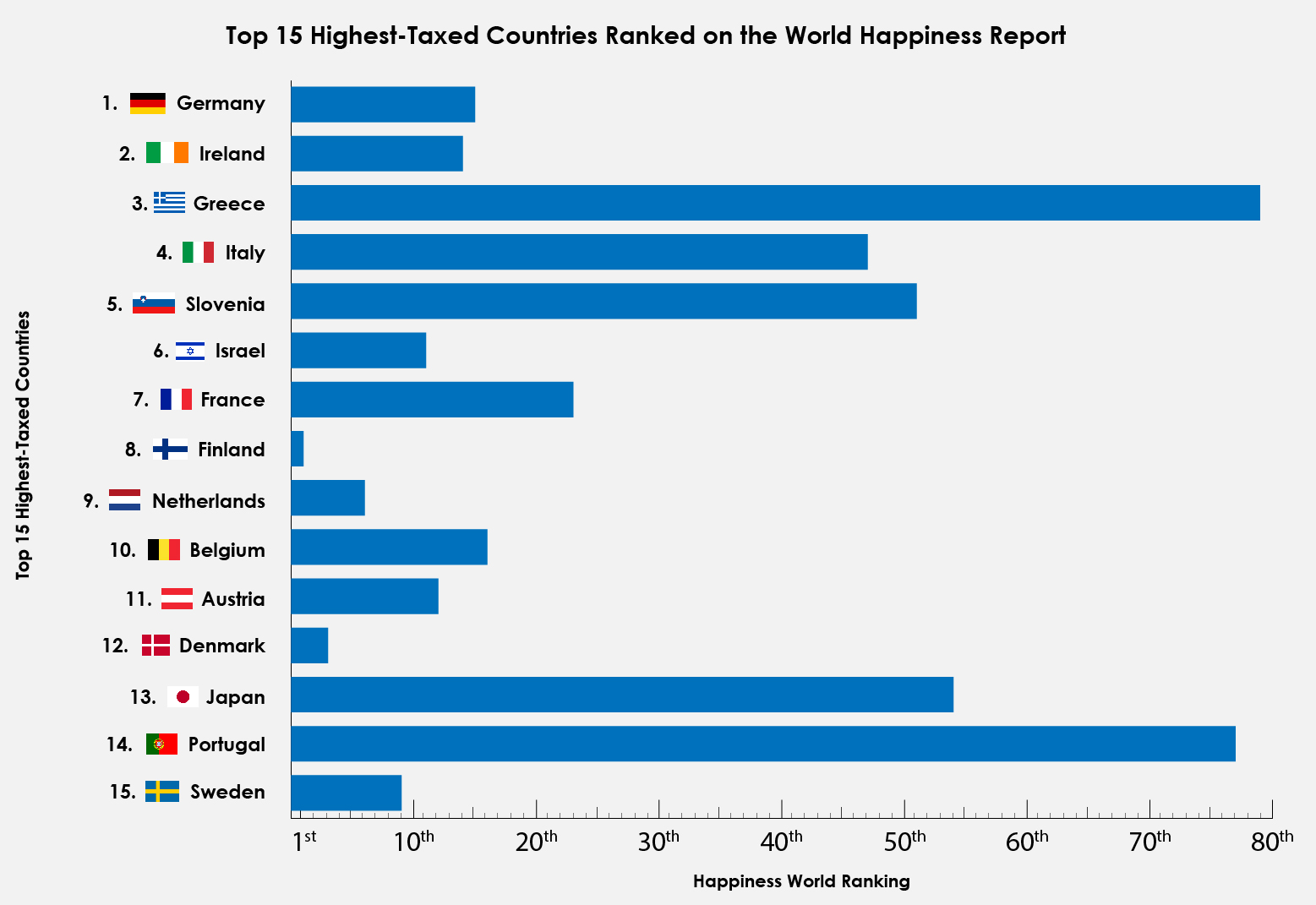

Does Lower Income Tax Make A Happier Country

We Specialize In Non Qm Loans And Has Great Solutions For People That Have An Individual Tax Identification Number It Home Ownership Home Buying The Borrowers

Realtymonks One Stop Real Estate Blog Tax Attorney Property Tax Tax

Orange County Ca Property Tax Calculator Smartasset

15 Self Employment Tax Deductions In 2022 Nerdwallet Capital Gains Tax Income Tax Brackets Income Tax Return

Does Lower Income Tax Make A Happier Country

12 Ways To Beat Capital Gains Tax In The Age Of Trump

What Are Salary Taxes For Software Engineers In The Usa Quora

Does Lower Income Tax Make A Happier Country

Top Tax Rate On Personal Income Would Be Highest In Oecd Under New Build Back Better Framework Income Tax Rate Income Tax

Self Employed People Can Get A Great Home Loan Home Loans Mortgage Loans Loan

Why Households Need 300 000 To Live A Middle Class Lifestyle